QuickBooks Review: The Pros, Cons, and Hidden Features You Should Know

If you’re running a small business or managing finances for a growing company, you’ve probably heard of QuickBooks. It’s one of the most popular accounting software solutions out there, designed to make your life easier by handling invoices, tracking expenses, and giving you instant financial reports. But with so many accounting tools available, you might be wondering: Is QuickBooks really worth it?

In this review, I’ll take a deep dive into what QuickBooks offers, including its features, pricing, pros and cons, and how it stacks up against competitors like Xero and FreshBooks. By the end, you’ll have a clear idea of whether QuickBooks is the right fit for your business.

What is QuickBooks?

Choosing the right financial tools is essential, and QuickBooks stands out for its scalability and ease of use.

QuickBooks is an accounting software developed by Intuit that helps businesses manage their finances. It is widely used by small and medium-sized businesses to handle bookkeeping, invoicing, payroll, and tax preparation. The software simplifies financial management by organizing income and expenses, tracking sales, and generating reports.

Businesses use QuickBooks to maintain accurate records of their financial transactions, ensuring compliance with tax regulations and making informed decisions. It provides tools to create and send invoices, track payments, and monitor cash flow. Many business owners rely on it for bank reconciliation, which helps match transactions recorded in QuickBooks with those in bank statements.

The software supports different business structures, including sole proprietorships, partnerships, and corporations. It also helps with tax preparation by categorizing transactions and generating reports needed for filing tax returns. Accountants and financial professionals often recommend QuickBooks because it simplifies financial reporting and makes collaboration easier.

QuickBooks is available in different versions, including desktop and cloud-based options. The cloud-based version, QuickBooks Online, allows users to access financial data from anywhere with an internet connection. This flexibility makes it a popular choice for business owners who need real-time access to their accounts.

Over the years, QuickBooks has become one of the most trusted accounting solutions due to its user-friendly interface and ability to automate many financial tasks. It helps businesses stay organized, reduce errors, and gain better control over their financial health. Whether used by business owners, bookkeepers, or accountants, QuickBooks plays a key role in managing finances efficiently.

Features: What Can QuickBooks Do for You?

From invoicing to tax preparation, QuickBooks offers a range of tools to keep finances organized and accurate. Let’s explore some of its standout features.

1. Effortless Invoicing & Payment Tracking

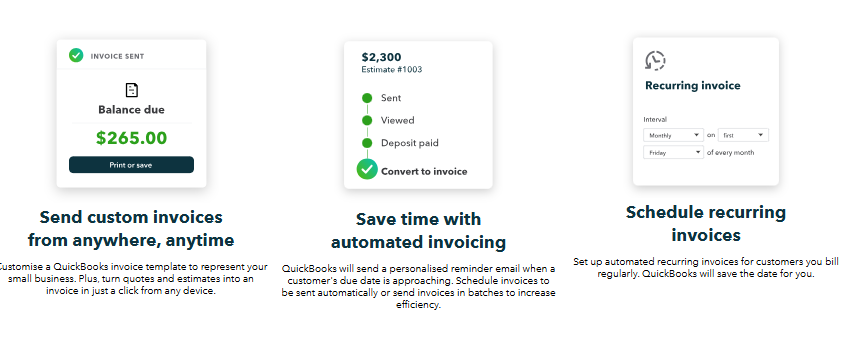

Ever struggled to keep track of invoices? With QuickBooks, you can send unlimited invoices on the go and track who has (or hasn’t) paid. You can also set up automated reminders for late payments, which means fewer awkward emails chasing clients for money. Plus, you can quickly convert quotes into invoices and even schedule recurring invoices for regular clients. This feature is particularly useful for freelancers and businesses with ongoing service contracts, as it ensures timely payments and minimizes missed invoices.2. Seamless Bank Connectivity & Transaction Management

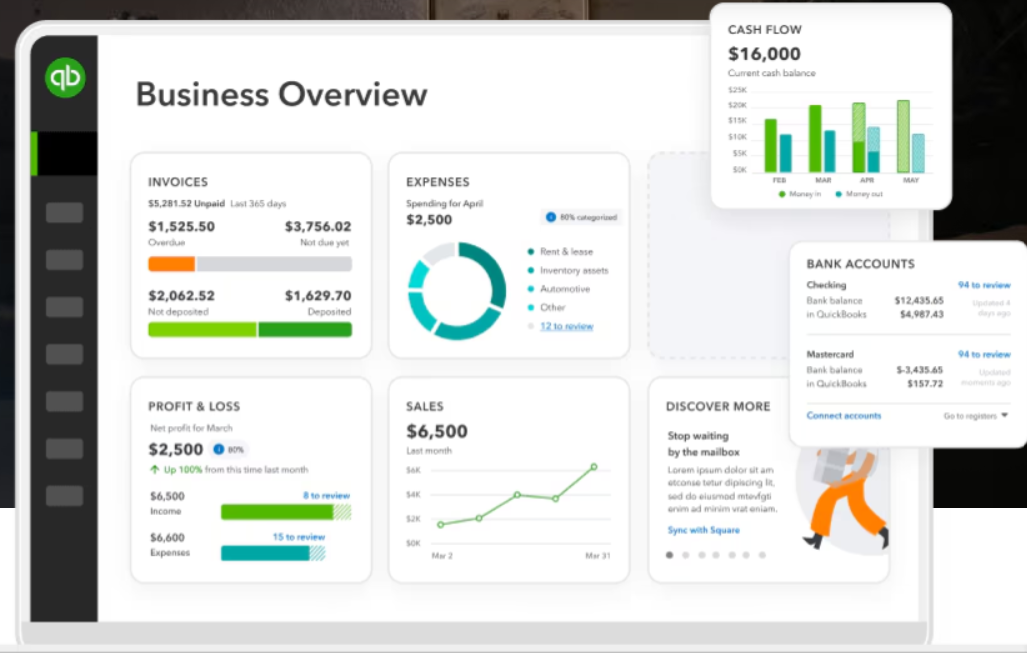

No one enjoys manually entering transactions, and thankfully, QuickBooks automates this process. You can connect your bank account and let the software import transactions automatically. This not only saves time but also reduces errors, ensuring your financial records are always up to date. By categorizing transactions and matching them with invoices or expenses, QuickBooks helps maintain accurate financial data. This automation is a huge benefit for business owners who need to focus on operations rather than data entry.3. Real-Time Financial Reporting

Want to know how your business is doing at a glance? QuickBooks offers customizable financial reports that give you instant insights into revenue, expenses, and profits. Whether you need a basic profit and loss statement or a more detailed balance sheet, QuickBooks has you covered. These reports help business owners make informed financial decisions, plan budgets, and prepare for tax season. With easy-to-understand visuals and metrics, users can quickly assess their financial health and identify areas that need improvement.4. Expense & Receipt Management

Managing expenses can be a hassle, but QuickBooks simplifies it with receipt capture and organization. You can take pictures of your receipts, categorize expenses, and attach them to transactions—all from your phone. This makes tax time way less stressful! Businesses can track every purchase and ensure they claim all deductible expenses, reducing their overall tax liability. Additionally, by integrating with credit cards and bank accounts, QuickBooks automatically updates expense records, minimizing the risk of lost receipts or untracked spending.5. Multi-Currency & VAT Tracking

If you deal with international clients, you’ll love QuickBooks’ multi-currency support. It automatically converts transactions to your home currency, ensuring accurate records. Plus, it tracks VAT for tax compliance, so you don’t have to worry about miscalculations. This feature is particularly beneficial for e-commerce businesses and companies operating globally, as it simplifies financial reporting and tax obligations across different countries.6. Project & Inventory Management (For Growing Businesses)

If you’re running a business with multiple projects or inventory, QuickBooks’ higher-tier plans let you track project profitability and manage inventory levels efficiently. This is a game-changer for businesses dealing with physical products. By keeping real-time records of stock levels, QuickBooks prevents overstocking or running out of essential items. Additionally, businesses can allocate costs and revenue to specific projects, helping them determine profitability and manage resources effectively.7. Workflow Automation & Customization

For those who love automation, QuickBooks lets you automate workflows (e.g., recurring invoices, scheduled reports). You can also customize dashboards and sync data with Excel, making it easier to analyze financial trends. Automation reduces manual workload, freeing up time for more strategic tasks. Businesses can also set up custom alerts for financial activities, such as overdue invoices or cash flow changes, ensuring they stay on top of their financial obligations.Pricing: How Much Does QuickBooks Cost?

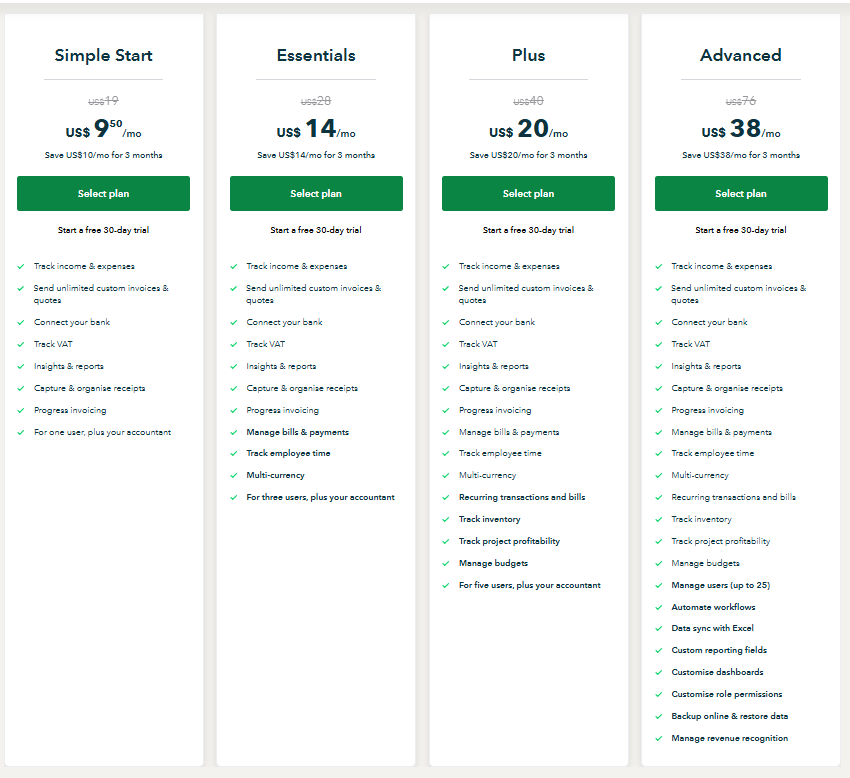

QuickBooks offers four pricing plans tailored to different business needs. Here’s a detailed breakdown:

-

Simple Start – $9.50/month (first 3 months), then $19/month

- Best for freelancers and small businesses needing basic accounting tools.

- Tracks income and expenses, creates invoices, connects to bank accounts, manages VAT, generates reports, and organizes receipts.

- Supports 1 user + accountant.

-

Essentials – $14/month (first 3 months), then $28/month

- Ideal for growing businesses that need additional tracking and management tools.

- Includes all Simple Start features plus bill and payment tracking, time tracking, and multi-currency support.

- Supports 3 users + accountant.

-

Plus – $20/month (first 3 months), then $40/month

- Suitable for businesses needing more advanced financial management tools.

- Includes all Essentials features plus inventory tracking, recurring transactions, project profitability tracking, and budget management.

- Supports 5 users + accountant.

-

Advanced – $38/month (first 3 months), then $76/month

- Designed for larger businesses requiring automation and detailed reporting.

- Includes all Plus features plus workflow automation, custom reports, Excel sync, role-based permissions, backup and restore, and support for up to 25 users.

Is QuickBooks Worth the Cost?

QuickBooks isn’t the cheapest accounting software, but it offers significant value. The first three months come at a discounted rate, making it affordable to test. Businesses that need automation, scalability, and financial insights will find the higher-tier plans well worth the investment. Whether you’re a freelancer or a growing company, QuickBooks provides flexible options to match your needs.

Pros & Cons: The Good, the Bad & the Ugly

Pros

- Super User-Friendly

- Time-Saving Automation

- Scalable for Different Business Sizes

- Comprehensive Reporting

- Multi-User Support

Cons

- Pricing Increases After Three Months

- No Native Phone Support

- No free plan

- Slight learning curve

- Customer Support Can Be Hit or Miss

QuickBooks is one of the most widely used accounting software solutions, offering a range of tools to simplify bookkeeping, invoicing, and tax preparation. But is it the right choice for you? Let’s explore the pros and cons.

Pros of QuickBooks

✔ Super User-Friendly – QuickBooks is designed for ease of use, even if you’re not an accountant. The interface is intuitive, and the dashboard provides a clear overview of income, expenses, and cash flow. With easy navigation and guided setup, even beginners can get started quickly.

✔ Time-Saving Automation – One of QuickBooks’ standout features is automation. It connects to your bank account and automatically imports transactions, categorizes expenses, and generates invoices. Recurring invoices and payment reminders save time and reduce manual work.

✔ Scalable for Different Business Sizes – Whether you’re a solo entrepreneur, small business owner, or managing a growing company, QuickBooks has pricing plans that scale with your needs. The platform offers flexibility for different industries and business sizes.

✔ Comprehensive Reporting – QuickBooks provides in-depth financial reports, including profit and loss statements, balance sheets, and cash flow reports. These reports help businesses make data-driven decisions and stay on top of their financial health.

✔ Multi-User Support – Need to collaborate with a bookkeeper or accountant? QuickBooks allows multiple users on higher-tier plans, with role-based permissions to control access levels. This feature is essential for growing businesses that need secure financial management.

✔ Seamless Integrations – QuickBooks integrates with a wide range of third-party apps, including PayPal, Shopify, Square, and CRM tools. These integrations allow businesses to streamline operations and keep financial data connected across platforms.

Cons of QuickBooks

✘ Pricing Increases After Three Months – QuickBooks frequently offers an introductory discount for new users, but once the three-month period ends, the regular pricing can be quite high. This can be a challenge for small businesses on a tight budget.

✘ Basic Plans Lack Essential Features – The most affordable plans come with limitations. Features like inventory tracking, time tracking, and multi-user access are only available in higher-tier plans, requiring businesses to upgrade for full functionality.

✘ Learning Curve for Advanced Features – While QuickBooks is beginner-friendly, some of the more advanced features—such as project tracking, budgeting, and tax customization—can take time to understand. Business owners may need additional training or support to maximize these features.

✘ Occasional Syncing Issues – Some users report problems with bank feeds and third-party integrations. Transactions may not always sync correctly, leading to discrepancies in financial records that require manual fixes.

✘ Customer Support Can Be Hit or Miss – QuickBooks offers multiple support channels, but response times and issue resolution can be inconsistent. Some users experience excellent support, while others find it difficult to get timely assistance.

QuickBooks vs. Competitors: How Does It Compare?

Here’s a quick comparison with other popular accounting software:

| Feature | QuickBooks | Xero | FreshBooks | Wave |

| Pricing | Starts at $9.50/mo (discounted) | Starts at $13/mo | Starts at $17/mo | Free |

| Invoicing | Unlimited invoices | Unlimited invoices | Limited in lower plans | Unlimited invoices |

| Bank Connectivity | Yes | Yes | Yes | Yes |

| Expense Tracking | Yes | Yes | Yes | Yes |

| Multi-User Support | Up to 25 users | Unlimited users | Limited users | 1 user |

| Inventory Tracking | Available on Plus & Advanced | Available | Not available | Not available |

| Project Management | Yes | Yes | Yes | No |

| Automation | Advanced workflow automation | Basic automation | Basic automation | Limited |

Which One Should You Choose?

Selecting the right accounting software depends on your business size, budget, and required features. Here’s a detailed comparison to help you decide:

- QuickBooks – Ideal for small to medium-sized businesses needing a powerful, scalable solution. It offers automation, robust reporting, payroll integration, and inventory management. If you require advanced accounting tools with strong support and customization, QuickBooks is a solid choice.

- Xero – A great alternative for businesses looking for unlimited users at a lower cost. It’s cloud-based, easy to use, and supports multi-currency transactions. Xero is perfect for businesses needing seamless integrations with third-party apps and a collaborative financial platform.

- FreshBooks – Best suited for freelancers, consultants, and small service-based businesses. It simplifies invoicing, time tracking, and expense management. With an intuitive interface and strong client management features, FreshBooks is excellent for self-employed professionals.

- Wave – A budget-friendly option, offering free accounting tools for startups and solo entrepreneurs. It includes invoicing, expense tracking, and basic reports at no cost. If you need simple, no-frills accounting software without a monthly fee, Wave is the best choice.

Each platform has unique strengths, so choose the one that aligns with your business needs, future growth, and financial management preferences.

Final Verdict: Should You Get QuickBooks?

If you’re looking for an all-in-one accounting solution that simplifies financial management, QuickBooks is a fantastic choice. It’s easy to use, automates tedious tasks, and scales as your business grows. While it’s not the cheapest option, the time it saves and the financial insights it provides make it worth the investment.

Who Should Use QuickBooks?

✅ Freelancers & Small Businesses – Simple Start or Essentials plan.

✅ Growing Businesses – Plus plan with project tracking and inventory management.

✅ Large Enterprises – Advanced plan with workflow automation and multi-user access.

If you’re serious about keeping your finances in order, QuickBooks is a game-changer. Ready to try it out? Take advantage of the 30-day free trial and see if it fits your business!